Here’s a new post from our Patient Correspondent, Patricia Han, RN, about Medicare Drug Plans. She’s a retired nurse with many chronic health problems who used to be employed by a payer. I always learn something that a doctor ought to know from her real world examples of the way insurance coverage does (and doesn’t) work.

–Caroline

I previously posted an article about why I switched from my Medicare Advantage plan to traditional Medicare. As a patient with chronic wounds, I am very glad I did. I was paying huge sums out of pocket for wound care under my MA plan. If you had the same problem and were able to switch back to traditional Medicare, I know you won’t be sorry, but there are some things you need to know about the Medicare drug plan.

Your Medicare Drug Plan can be changed yearly from Oct 15 thru Dec 7 (the enrollment period), which means now’s the time to evaluate how it’s working for you.

Here are the steps to evaluate your Medicare drug plan:

1. What is your deductible on your current drug plan?

The deductible is the amount of money you have to pay before your plan starts paying for their portion of your medications.

2. What is your monthly premium?

The enrollment period is also the time when you monthly premium can go up – so find out what it is going to be.

Example: My monthly premium for drugs is $45 this year and next year it’s going up to $65.

3. Check to see what “Tier” your drugs are in and has the tier changed?

The drugs you are on may have changed “tiers” and that means your cost will change because as I show in the example below, there’s a high deductible for Tier 4 and 5 drugs.

4. What is the preferred pharmacy for your plan?

Is it close? Is it one you like?

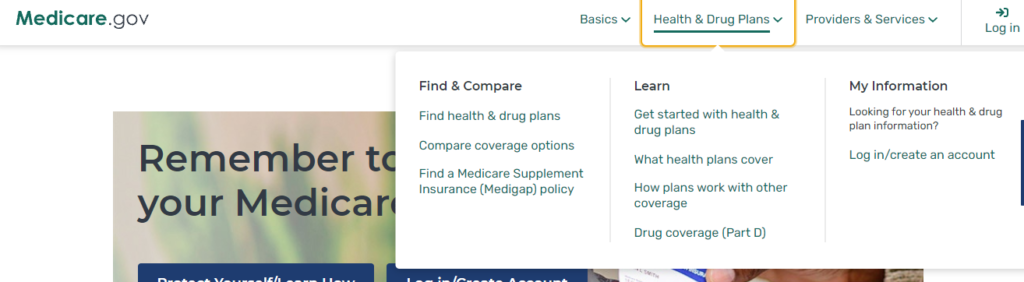

Now, go to Medicare.gov:

(You will probably have to register). Put in the name of your medication in then shop all the Medicare apart D for drug plans.

Here’s my personal example of why I chose a new plan this year.

My main concern this year is my most expensive drug, Victoza injectable for Diabetes. In shopping around, on most plans I would have to pay $445 (the deductible) before the drug plan begins to pay their portion. However, in my current plan, my diabetes medication is a TIER 4 and the plan has a $100 deductible for all medications in Tier 4 and 5.

The new plan I chose has a premium of $45 monthly, which is higher than most plans. So why did I choose it? Because under the new plan, Victoza is in Tier 3 and does not have that $100 deductible! Under the new plan I don’t pay that $100 each time I get the drug filled, so it’s a big savings overall.

However, after I got the new drug plan, my doctor prescribed a very old medication called Nutrofurantoin, which is generic for Macrobid. For some reason, this old generic drug is a Tier 4 medication in my new plan and I would have to pay a $100 deductible for it! However, since it’s an old drug that’s been around a long time, I went to “Good Rx,” and there it is at $11.39! In other words, on my new plan it’s cheaper to pay cash at Good Rx for this antibiotic – but I don’t take that medication often, and I take the diabetes medication every day. That means that my new plan is still a good deal.

That means you have one more step as you decide about your new drug plan:

5. Compare your Prescription price to Good RX

I hope you found this useful!

–Patricia Han RN

Dr. Fife is a world renowned wound care physician dedicated to improving patient outcomes through quality driven care. Please visit my blog at CarolineFifeMD.com and my Youtube channel at https://www.youtube.com/c/carolinefifemd/videos

The opinions, comments, and content expressed or implied in my statements are solely my own and do not necessarily reflect the position or views of Intellicure or any of the boards on which I serve.