Dear Dr. Fife,

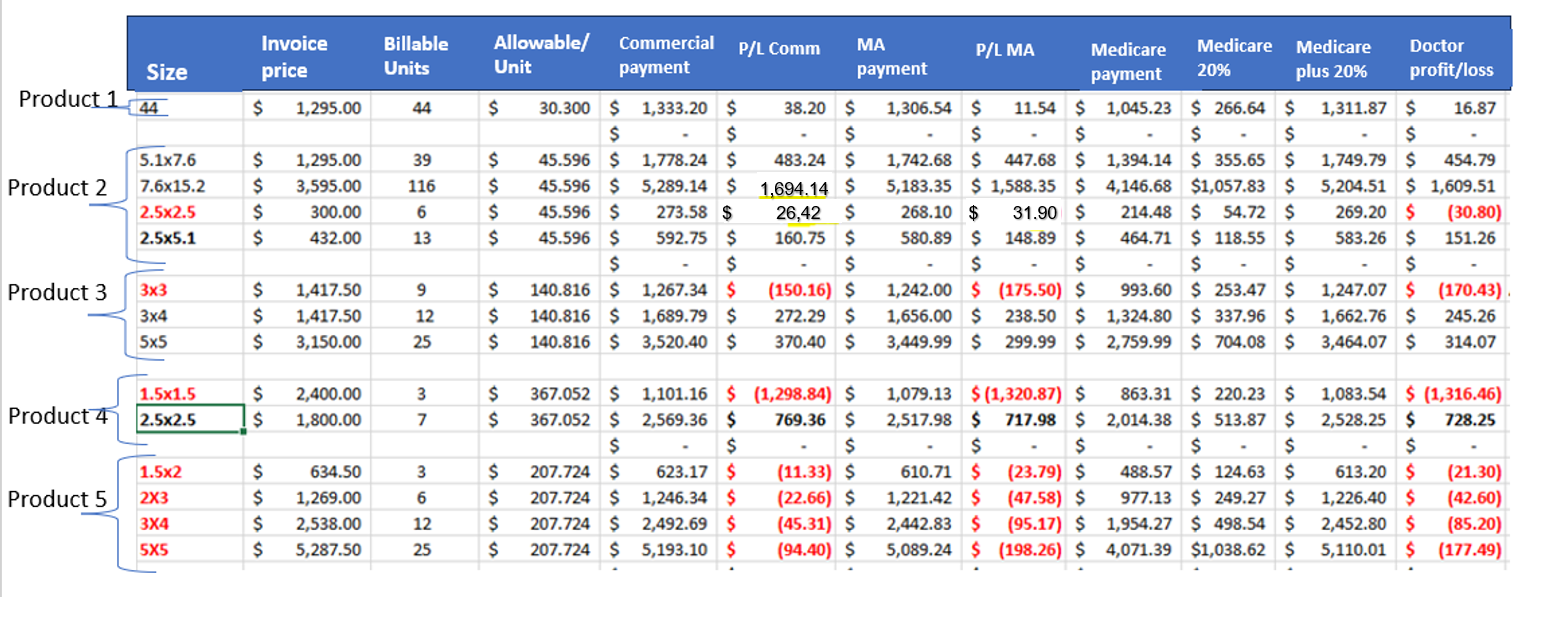

I thought people should understand what happens to doctors who play by the rules when it comes to the use of Cellular Tissue-Based Products / Skin Substitutes in their private office. Here’s a spreadsheet explaining what happens to my practice (office based wound center) with 5 different products. All the Cellular Tissue-Based Products / Skin Substitutes in red on the table are products for which we lose money in the doctor’s office when playing by the rules. Here’s why:

- Smaller pieces cost more: The Average Sales Price (ASP) is based on the per square centimeter price of the product. However, the dirty secret of the ASP is that the manufacturers claim that smaller pieces cost them more to produce – so THE MANUFACTURERS CHARGE US MORE FOR SMALLER PRODUCTS, REGARDLESS OF THE ASP! That means we lose money if we use smaller products because we are paying more than the ASP per square centimeter- and thus more than we can get reimbursed.

- In the past, we were able to manage this unfair pricing situation by using large pieces so that the ASP calculation was fair – until CMS started denying payment if we used a larger piece when a smaller piece of that product existed – a policy they implemented due to the shenanigans of unscrupulous doctors and manufacturers. Since Medicare now says that the “wastage” cannot be significant, we are not able to use the size of the product that will get paid at the ASP (list) price if it’s significantly larger than the wound. The result is that the patients and providers are limited as to the CTP/skin sub options that are available to them.

- The Sequester: Remember that in the office setting, the 2% sequester is still in force. This means that CMS reduces all payments by 2%, including the product reimbursement. That is another reason we often pay more for the product than we can ever get reimbursed.

Keep in mind that the amount the physician gets from CMS that is the unadjusted national average. That means, if you live in California, you get paid a lot more than if you live in Alabama. On top of that, CMS deducts the 2% sequester on every line of the HCFA 1550 billing form, which means that there is a 2% reduction of payment on the cost of the PRODUCT as well as a 2% reduction of the physician FEES. Product pricing does not change based on geography, which creates a bias against some of the states with the highest rates of amputation from DFUs.

Now let’s consider the patient out-of-pocket expense. If the patient has traditional Medicare fee for service (FFS), they are responsible for 20% of the Medicare allowable rate and, if they do not have a Medicare supplemental insurance plan, must pay that out of pocket. If they have Medicare Advantage (MA), they must first pay all of their out-of-pocket/deducible fees, which currently range around $6,000 – $7,500 per year, based on what patients tell us. In other words, until they have paid that deductible amount, their MA plan does not start covering costs. That means, at the beginning of the year, a patient could be paying 100% of the cost of a CTP/skin sub until their deducible is met and the MA plan takes over.

You can see why it is tempting to enter into various deals with the manufacturers because doing it “by the book” can easily mean losing money on CTPs/skin subs in the doctors’ office. No wonder these companies offer under-the-table discounts and doctor’s take them.

When representatives from various companies come to call, they like to tout the effectiveness, efficacy, and ease of application of their product. That means nothing to us if we can’t use the product for economic reasons. We are focused on the pricing structure – not because we are trying to see how much profit we can make off of “the spread,” but because we don’t want to LOSE money.

The bottom line is that because I play by the rules, I can’t use CTPs/skin subs on some of the patients who most need it, unless I want to go broke.

Key to the table above:

- Size is the size of the product in square centimeters.

- Invoice price is what we PAID to purchase the product. To be clear, playing by the rules, the invoice price is what we ACTUALLY PAID – there are no hidden discounts, rebates or other incentives.

- Billable units is the number of units that CMS tells us we can bill for a product of that size.

- Allowed per unit: Based on the Average Sales Price (ASP) per CMS, this is the max allowable, which is the product ASP plus the 6%

- Commercial payment is the ASP x the number of units- since the commercial payers tend to follow the ASP pricing

- P/L (Profit/Loss) Commercial is what my practice makes or loses on a patient with private/commercial insurance based on the actual cost of the product and the actual reimbursement

- MA (Medicare Advantage) payment is based on the Medicare ASP but includes a 2% reduction for the sequester!

- P/L (Profit/Loss) of Medicare Advantage is what my practice makes or loses on a patient with Medicare Advantage, based on the actual cost of the product and the actual reimbursement

- Medicare Payment is the reimbursement under traditional Medicare fee for service (FFS) which is 80% of the ASP

- Medicare 20% is the patient responsible portion

- Medicare plus 20% is the reimbursement if we are able to collect the 20% co-pay

- Doctor Profit/Loss is how much my practice will make or lose with each size of these products

Signed,

A Frustrated Honest Doctor

Dr. Fife is a world renowned wound care physician dedicated to improving patient outcomes through quality driven care. Please visit my blog at CarolineFifeMD.com and my Youtube channel at https://www.youtube.com/c/carolinefifemd/videos

The opinions, comments, and content expressed or implied in my statements are solely my own and do not necessarily reflect the position or views of Intellicure or any of the boards on which I serve.