Physicians have watched their inflation-adjusted Medicare payments decline 26% from 2001 to 2023, because practitioners are just about the only entity whose reimbursement is NOT tied to inflation. Physicians in all specialties agree that the current Medicare physician payment system needs reform and that an annual inflationary update must be the foundation of any reforms.

Theoretically, physician practice expense is tied to an economic index, and the one that has been used for decades is the Medicare Economic Index (MEI). The MEI consists of two categories reflecting the resources used in medical practices: (1) physician practice costs and (2) physician compensation (physician work). The AMA has created a two-page explainer on the Medicare Economic Index (PDF) which outlines how it incorporates these two categories reflecting the resources used in medical practices.

The problem is that physician payment isn’t really tied to the MEI (or any other index of actual costs). Since 1992, annual Medicare payment updates for physicians have been “adjusted” in a variety of ways. The Medicare Access and CHIP Reauthorization act (MACRA) of 2015 eliminated the Sustainable Growth Rate (SGR) formula because if it had been implemented as written, that year it would have resulted in a 25% decrease in physician payment. However, for budgetary reasons, MACRA’s updates were set by statute at numbers that from the beginning were judged unsustainable (e.g., 0.25% in 2026). Providing an MEI update for physician payments (like those provided to virtually all other Medicare providers) will enable physician practices to better absorb other payment redistributions performance adjustments, as well as periods of high inflation and rising staffing costs (such as exist right now).

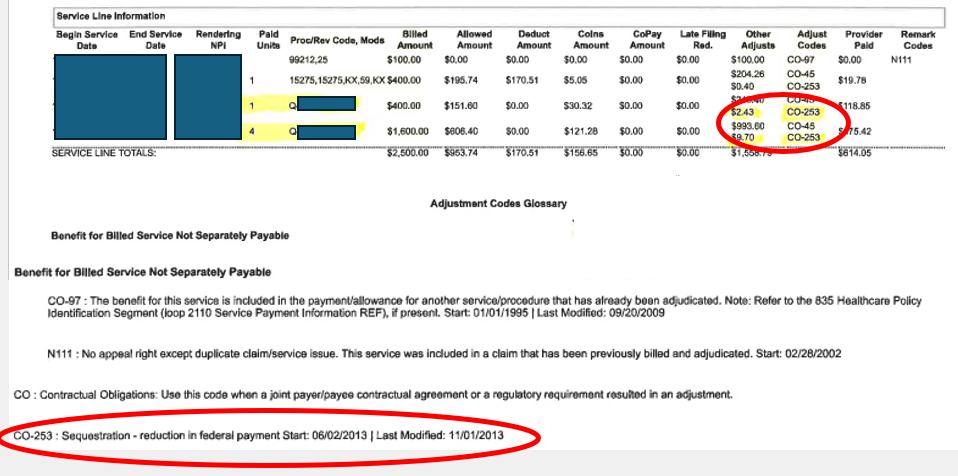

Although Social Security recipients receive a cost-of-living adjustment every year, the physician fee schedule has no mechanism for reflecting these ongoing changes to the bottom line of office overhead and salaries. In addition, the physician fee schedule was impacted by the Medicare Sequestration Payment Reductions that started in 2013, which was defined in the Budget Control Act of 2011. There was a temporary pause during the pandemic, but it has been reinstated as of July 1, 2022. This appears as “adjustment code CO 253” on claims, which indicates “Sequestration – reduction in federal payment” as the reason (see example). This reduction impacts every line item on a HCFA 1500, including charges that are associated with products such as cellular tissue products. So, in addition to the reduction in the conversion factor for RVU’s that has steadily declined due to the Balanced Budget Act, there is an additional 2% reduction that has been essentially ignored by the press, but which impacts physician reimbursement even more profoundly. And it’s about to get WORSE. Based on the proposed physician payment rule that was just released, the 2025 Medicare conversion factor is set to decrease for the fifth straight year by approximately 2.80% from $33.2875 to $32.3562. Unfortunately, these cuts coincide with ongoing growth in the cost to practice medicine as CMS projects the increase in the Medicare Economic Index (MEI) for 2025 will be 3.6%.

This reduction is a big deal for wound and hyperbaric practitioners whose patients on average are over 65 and a high percentage of whom have Medicare or Medicare Advantage plans. There is a trend for more wound care services to be delivered in the office-based setting. However, without an appropriate increase for inflation, more and more physicians are going to leave the practice of wound care and indeed, the practice of medicine. The problem is that the current physician payment calculations were set by statute. Only Congress can change the statues that impact physician payment.

–Helen Gelly, MD

Dr. Fife is a world renowned wound care physician dedicated to improving patient outcomes through quality driven care. Please visit my blog at CarolineFifeMD.com and my Youtube channel at https://www.youtube.com/c/carolinefifemd/videos

The opinions, comments, and content expressed or implied in my statements are solely my own and do not necessarily reflect the position or views of Intellicure or any of the boards on which I serve.

Never mind that the MediCare conditions for treating a DFU, if met, would mean that patient wouldn’t even have diabetes, the battle to minimize HBOT continues years after it should have been recognized as Standard-of-Care for many medical conditions.

After decades of being a hyperbarist, I am a firm believer that you can’t expect a government the condones and promotes harm to also be a government that will promote beneficial interventions. These are mutually exclusive.

It is my hope that when the dust settles on the coming economic collapse, which will also take out the USA corp, that medical care will become decentralized and based on what actually is efficacious not what makes money for some corporate entities that are in control of the centralized medical system.

The transition will undoubtedly be very difficult for many. Institutions will fall, entitlement programs will end, etc. Obviously jobs will be lost because the entire reimbursement paradigm will have changed.

Right now, we are rearranging the deck chairs on the Olympic (aka Titanic), but the ship will sink soon enough.