Check out the entire series here.

I have been making my way slowly through the March 2023 report from the Office of the Inspector General (OIG), OEI-BL-23-00010, “Some Skin Substitute Manufacturers Did Not Comply with New ASP Reporting Requirements.”

I’d glanced at it before, but until I started asking questions to really understand what was going on, I just didn’t understand the issues around ASP reporting. It’s been pointed out by individuals who’ve answered my questions that even publishing the ASPs of all these products won’t be enough to fix this mess, but it is a place to start. It’s a requirement that is already in place, is being ignored and per the OIG, would save millions of dollars. Remember that some manufacturers are using the fact that an ASP has been established (and thus no invoice is needed), to increase “the spread” by offering deep discounts which might not be reported to CMS by the physician. That’s why ASP reporting alone won’t fix the issue, but it likely would help. The message of the OIG report is that having an ASP for all the products would still save both Medicare and patients millions of dollars. You should read the whole report (it’s not very long), but I am going to provide some excerpts:

Key Results:

- CMS calculated ASP-based payment amounts for 38 of the 68 skin substitutes included in our review.

- CMS was unable to calculate ASP-based payment amounts for the remaining 30 skin substitutes because manufacturers did not report the required ASP data.

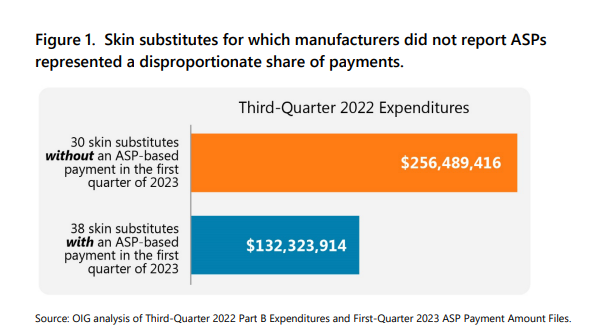

- These 30 skin substitutes represent a disproportionate share of Part B spending.

- Transitioning skin substitutes to ASP-based payments has the potential to substantially reduce Part B expenditures.

- CMS faces hurdles in setting ASP-based payments for skin substitutes.

Despite the new legislative requirements, CMS was unable to calculate ASP-based payment amounts in the first quarter of 2023 for 30 of 68 skin substitute billing codes because their manufacturers did not report the required ASP data. According to our analysis, Part B payment amounts would be reduced substantially if ASPs were consistently reported and used, potentially leading to tens of millions of dollars in savings each quarter. However, CMS faces several unique hurdles in implementing ASP-based reimbursement for skin substitutes. For example, because skin substitutes are not actually prescription drugs, CMS cannot employ its usual methods and data sources to corroborate manufacturer-reported data on pricing and packaging. . . However, every quarter in which wholesale acquisition costs/invoices are used as the payment basis for some skin substitutes potentially leads to tens of millions of dollars in higher payments for Medicare and its enrollees.

…In the third quarter of 2022 (i.e., the initial quarter in which payment amounts would have been affected by CAA reporting requirements), Medicare Part B and its enrollees paid almost $400 million for 68 unique skin substitute billing codes. CMS used ASPs to set payment for only 16 of the 68…CMS was unable to calculate ASP-based payment amounts in the first quarter of 2023 for the remaining 30 skin substitute billing codes because their manufacturers (26 in total) did not report the required ASP data. These 30 codes represent a disproportionate share of Part B spending. For example, Medicare and its enrollees spent $256 million for these 30 skin substitutes in the third quarter of 2022, accounting for nearly two-thirds of all payments for skin substitutes.

…Medicare Part B and its enrollees could save $84 million per quarter if all such products are paid for on the basis of ASPs. Twenty percent of that total (almost $17 million) would stem from reductions in the amounts owed through enrollee coinsurance.

…Current reimbursement practices could create incentives for providers to prefer skin substitutes that are paid for on the basis of WACs/invoices rather than those paid for using ASPs . . . as described earlier, WACs/invoices for skin substitutes often significantly exceed their ASPs. As a result, providers can typically capture a much larger spread (i.e., the difference between what they pay for a product and the amount they are reimbursed by Medicare) when payment is set using WACs/invoices. This effectively penalizes manufacturers who comply with the law by potentially making their products less attractive to providers…

…in its written response to OIG questions, CMS noted that: there is not a single database that lists all manufacturers of skin substitutes; many of these products are regulated as Human Cellular and Tissue-Based products for which the manufacturer is registered but the products do not receive individual FDA approval; …and there is not a single database or drug compendium that CMS can use to verify the descriptive data associated with skin substitutes (e.g., package size)…Therefore, CMS cannot readily determine which manufacturers should be submitting ASPs, nor can it consistently corroborate manufacturer-reported data on pricing and packaging by checking against FDA or private industry sources.

…Every quarter in which the current practices remain in place will likely cost Medicare and its enrollees tens of millions of dollars. Therefore, we encourage CMS to address the issues identified in this report as quickly as possible.

Dr. Fife is a world renowned wound care physician dedicated to improving patient outcomes through quality driven care. Please visit my blog at CarolineFifeMD.com and my Youtube channel at https://www.youtube.com/c/carolinefifemd/videos

The opinions, comments, and content expressed or implied in my statements are solely my own and do not necessarily reflect the position or views of Intellicure or any of the boards on which I serve.